Financial Statements And Characteristics Of Financial Statements

Financial statements are the statements that exhibits the periodic performance results through Profit & loss account (for Trading entities) or Income and Expenditure account (for Non- Trading Concerns), Financial position as on a particular day through Balance sheet, Cash flows and utilization of cash for various activities through Cash flow statement and the change or movement in share holding pattern through the statement of Equity. In brief, financial statements are the summarized and legally presented results of the transactions that were carried on by a business entity over a period.

Financial statements are prepared with an intention to make them understandable by the users and facilitate them to take correct decisions. These financial statements are prepared following a set of rules and regulations called as Principles or Concepts or Conventions or Standards issued by the government or the Accounting Standard Board.

Financial statements may be used by society at large in various ways:

- Internal users like the management and owners use the financial information or the financial statements for decisions like diversification or merger etc. These financial statements form part of the management’s report to shareholders.

- Employees use these reports to make Collective Bargaining Agreements (CBA) with the management for labour unions or individuals for discussing their compensation, promotions, pay hikes etc.

- Investors, creditors or lenders use these financial statements to assess their decision of investing or lending money to the company.

- Financial institutions like banks rely on these financial statements to assess the credit worthiness of the company and provide assistance for capital etc.

Financial statements assesses and communicates the company’s:

- Cash generating ability with the existing assets and the sources of generating the cash.

- Ability of the company to pay off its debts,

- Solvency position,

- Capital structure,

- Financial ratios of the company,

- Changes of Share holding pattern,

- Any chances for diversification or expansion of the company.

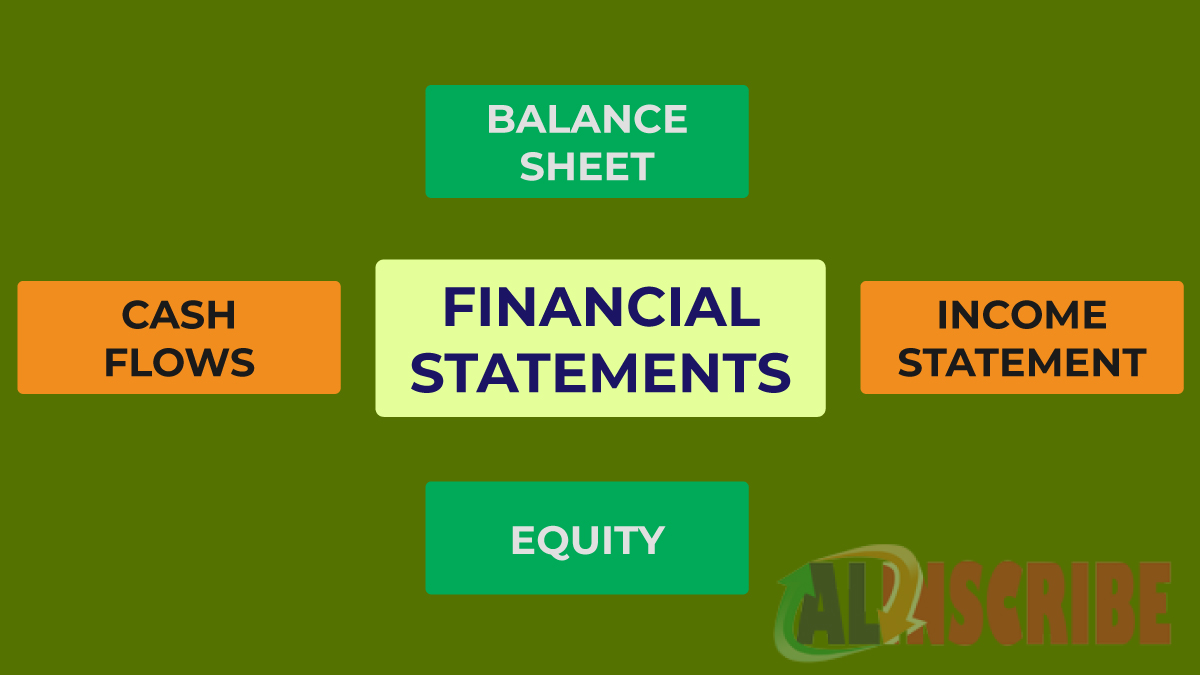

The Financial statements as a whole contains the following statements:

Balance sheet

The balance sheet shows the financial position, stock holders’ equity of the company on a particular date.

Profit and Loss account

Profit and Loss account shows the entity’s operational results for a period for which the statement was prepared.

Statement of Cash flows

which explains the cash flows during the reporting period.

Statement of Equity

which explains the changes or movement in the shareholding pattern of the entity.

In addition to above, supplementary notes including various activities, accounting framework such as GAAP, IFRS etc. are also included in the financial statements as Notes to accounts.

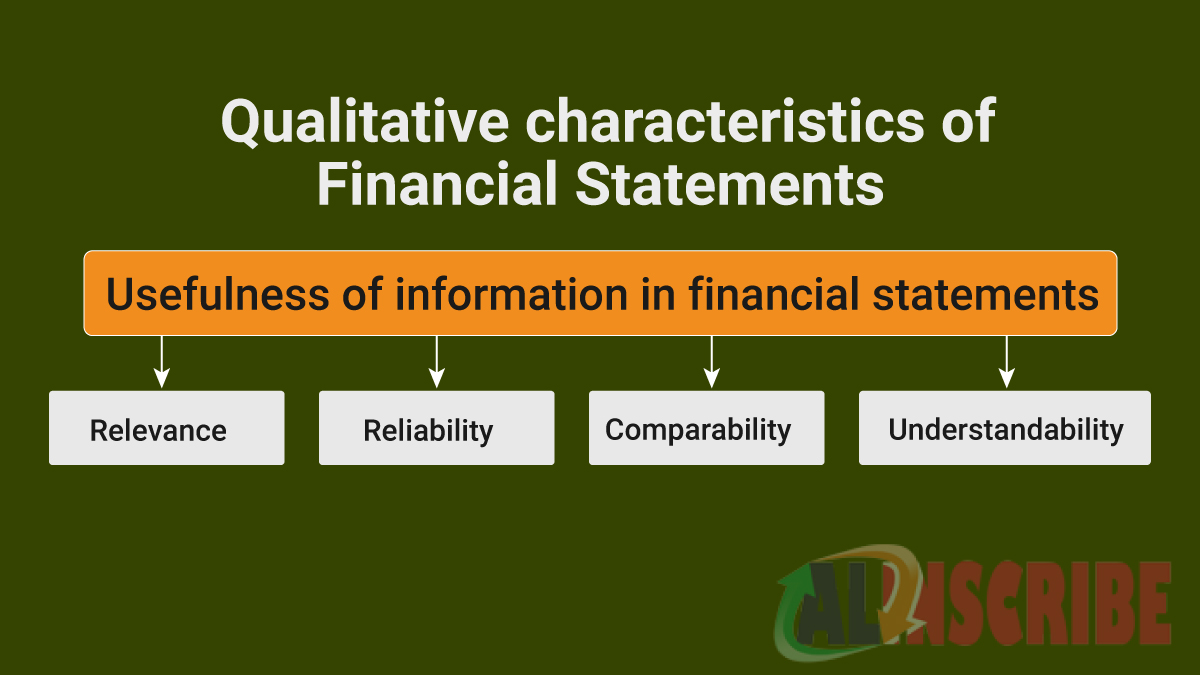

Characteristics of Financial Statements:

The qualitative characteristics of financial statements are as follows,

Understandability:

The information in financial statements should be understandable by the readers or users. This means that the information in the financial statements must be clearly presented with adequate foot notes and additional information to make understandable the information presented. The users or readers are assumed to have reasonable knowledge of the business and its activities.

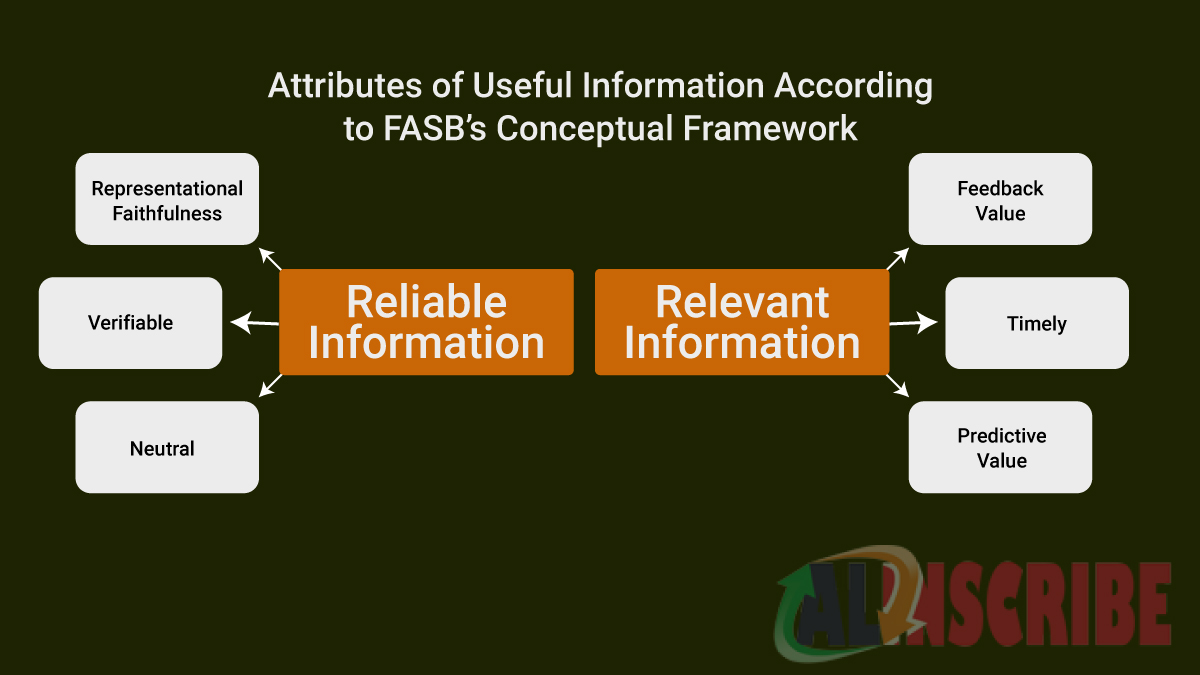

Relevance:

The information so presented must be relevant to the users as this information influences the decision making of the users. The information if based on predictions, the basis for those predictions shall also be explained and additional information for those shall be included.

Reliability:

The information must be reliable and free from material errors and biased judgments and not misleading. The information so presented shall represent transactions, events that represent the underlying substance of events and estimates based on prudence and proper disclosure.

Comparability:

The information presented in the financial statements shall be comparable with the information presented in earlier periods which enable the users or readers in identifying the trends in the entity’s performance. For this purpose, the policies and principles shall be followed and used consistently. The management has to clearly explain the different policies and principles if so adopted and the financial effect on the same. Compliance with Accounting standards and accounting policies used by the enterprise helps to achieve comparability.

Materiality:

The relevance of information will be affected by materiality. Any information is called Material Statement if its misstatement or its omission can affect the decisions of the users. Materiality depends on the size, nature and other characteristics of the transaction.

Faithful Representation:

The information included in the financial statements shall be represented with reasonableness.

Substance over Form:

The transactions presented in the financial statements shall be accounted and presented in accordance with the substance and its economic reality and not merely by their legal form.

Prudence:

The financial statements should be prepared with the Prudence concept. Prudence is the inclusion of a degree of caution in the exercise of the judgments in the estimates under the conditions such that assets or income are not overstated nor liabilities or expenses are understated.

Full disclosure:

The transactions that are recorded are to be recorded in full and the financial statements are prepared in conformity with GAAP (Generally Accepted Accounting Principles).

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.