Objectives And Functions Of Accounting - Everything you need to know

In the previous article, we have seen the meaning of the term “Accounting” and its history. In this article, we will discuss about what are the objectives and functions of accounting.

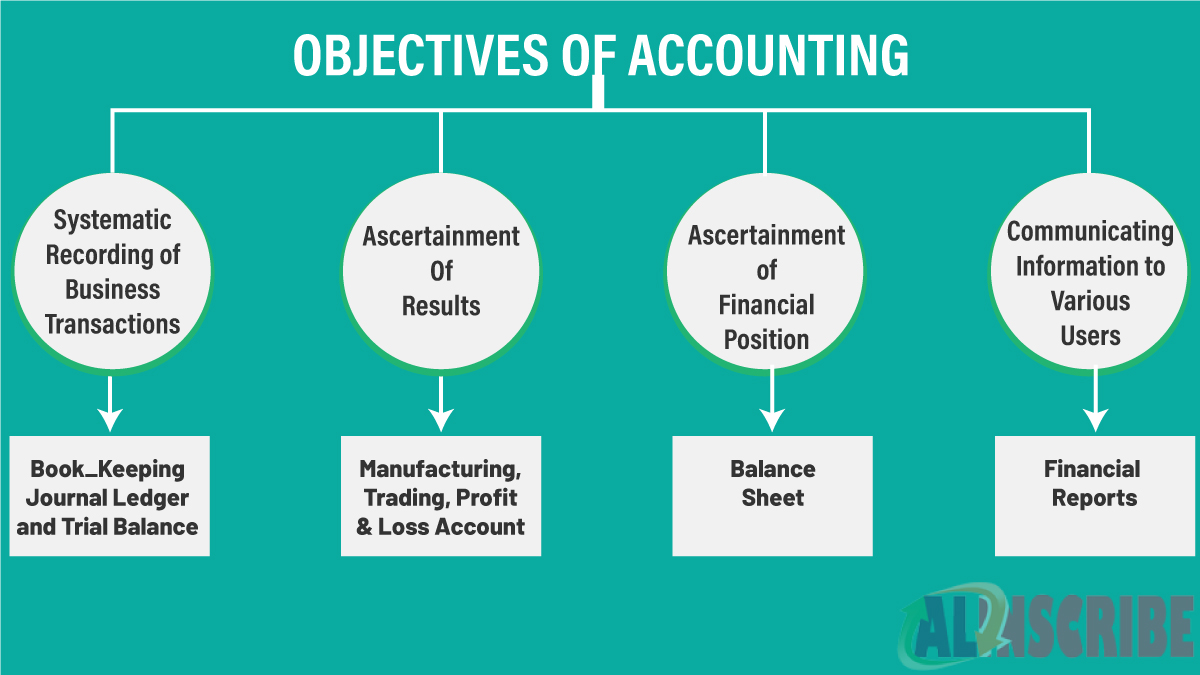

The objectives of accounting are given below:

1. To maintain complete and systematic recording of transactions:

The main and basic objective of accounting is to facilitate the entity to maintain complete set of accounting records and systematic recording of transactions. At a later point of time, these recorded transactions are classified, summarized in a logical manner to facilitate the preparation and presentation of financial statements to find the results of the enterprise. This recording is generally done in Journals or Day books.

2. Ascertaining results of above transactions:

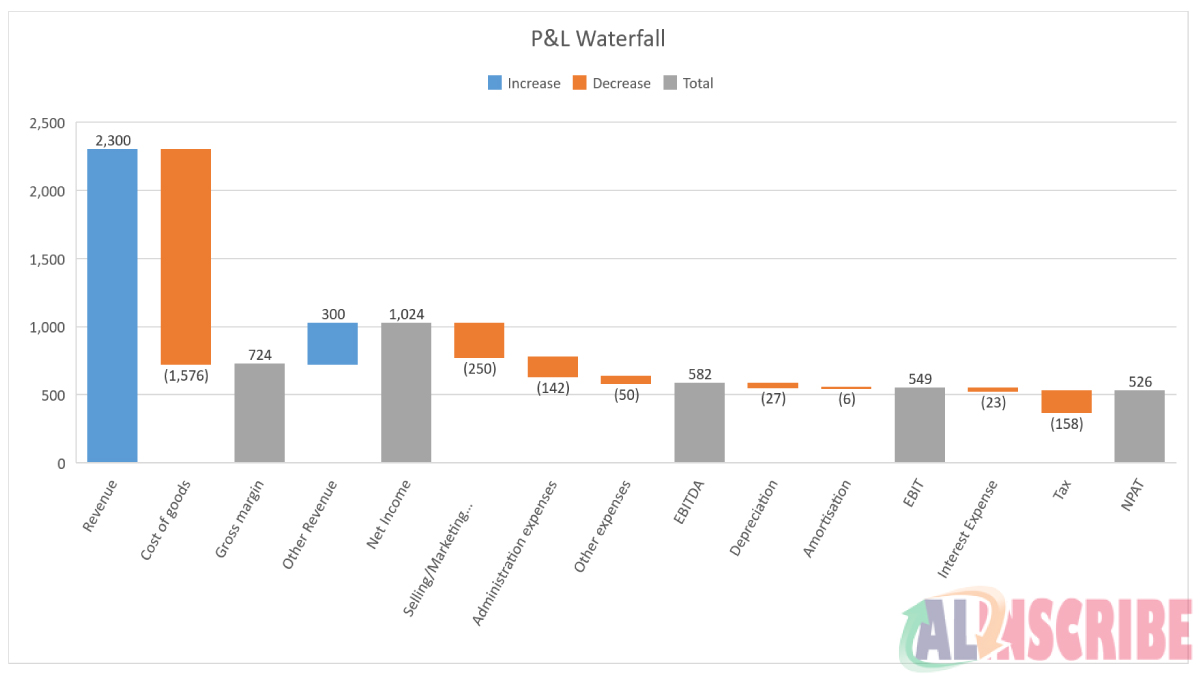

The above transactions recorded earlier are then transferred into respective accounts and then finally into the financial statements through preparation of ledger accounts and then Profit & Loss account. The Profit and Loss account is the statement showing the results of the business transactions that had taken place over a period of time.

Profit is a situation where the revenue of an entity exceeds the expenses which mean the entity is in profitable position.

Loss is a situation where the expenses exceed the amount of revenue. The management has to find out the reasons for the company going into losses and thrive to make it good.

Profit and loss account is prepared for a Profit motive or Trading industry. For Non – Trading entities, the Surplus or Deficit is found out by preparing Income and Expenditure account.

3. Ascertaining Financial position of the company:

Profit and loss account of an entity describes the operations that were taken place over the period for which the statement is prepared. Balance sheet is prepared to know the financial strength of the entity as on a particular day. It is determined in terms of Assets and Liabilities. What an entity owns and those things generate revenue to the entity are classified as Assets and those things which are outflow for the entity are called Liabilities.

4. Providing Information to the users for better decision making:

Accounting communicates the results of the financial statements to the users of the financial information and provides them information through various statements or accounts like cash flow statements, profit and loss accounts, statement of changes in equity, balance sheet etc.

With regards to managers or proprietors accounting also provides a check or control over the resources of the company and its utilization.

5. To assist the management

Accounting can assist the management of an organization by offering them with valuable interpretations and by analyzing financial data precisely. This contributes in management of a company more effectively.

Functions of Accounting:

The functions of accounting are:

Measurement:

It measures the operations of the business entity and provides the financial position of it on a particular date.

Forecasting:

Due to the capability of measuring and comparing the data or transactions, accounting provides a base for forecasting the future results based on the past data.

Comparison and Evaluation:

Accounting helps the users of the accounting information to compare the performance of a entity with its own past data or with benchmark or industry giants for decision making.

Control:

Accounting helps the management gain control over the business and its transactions and as well helps in finding out the operational and financial efficiency in the procedures and also to find out any discrepancies or weaknesses in the business.

Legal formalities:

Accounting is a legal requirement for an entity to exist in the market. Government agencies, tax authorities, bankers, creditors, lenders etc rely solely on the accounts of an entity.

Track of Assets and Liabilities:

Accounting helps the managers or the proprietor to have control over the assets (receivables) and liabilities (payables) and to plan the business strategies or operations accordingly.

Future oriented:

Accounting not only involves recording of transactions that have actually taken place, but also the probable upcoming or futuristic transactions which helps the entities to plan the finance or capital for the commitments like diversification, acquisition etc.

In some cases, this also helps the entities from going into insolvency situation by setting aside a part of the profit earned by the business for future unforeseen circumstances. I.e. recording of contingent liabilities etc.

Decision making:

The final use of accounting or the financial information is for the managers or users of financial information take decision.

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.