10 Essential Features To Look For In A Banking ERP Software

Technical advancements have accelerated the course of digital transformation of every possible business sector. Some industries have embraced these technical changes with great agility and flexibility, while others are still struggling to get a hold of everything.

The banking industry is one of the sectors to show extraordinary results upon settling for technically advanced tools, such as banking ERP software. Gathering, storing, and interpreting data has been easier with the help of these technically advanced systems. Especially in specialized industries like the banking industry, systems, and software need to be secure and functional enough to support all the complicated and complex tasks.

However, choosing the right banking ERP software is not as easy as it seems to be. There are more than 400 solutions in the market, and it is possible to get confused with all those. This is why we have prepared this article portraying 10 essential features to look for in banking ERP software. Different aspects associated with the same will be mentioned in this article as well.

Definition of banking ERP software

Banking ERP software is a type of ERP solution that is designed to meet every need of a financial corporation. These solutions are capable of matching most of the demands of a financial business while migrating and managing confidential and crucial data securely without leaving any room for any mistakes. Banking ERP software can make the tasks of deposits/credits, digital money flow, cash transactions, and many other facilities easy to access and perform.

Some of the necessary characteristics that need to be there in a banking ERP software are presented below,

Integrated:

An integrated banking ERP software allows the users to work under a single database and ecosystem. The core business processes are integrated and get easily integrated when you implement banking ERP software.

Real-time:

The finance sector is fast changing, and it is quite fickle. This fast-changing banking atmosphere requires fast responses in order to keep moving forward. One of the primary examples of this situation is the financial crisis of 2008. Banks that were able to offer a quick reaction were saved from huge losses, and banks that failed to do so were destroyed totally.

Unified:

A unified banking ERP software can establish and connect each of the branches with each other and with the headquarters. This can make it easy to access data and track performance with just a few clicks.

Multicurrency features:

Multicurrency features are one of the most important parts of banking ERP software. The multicurrency feature of the banking ERP software allows users to perform international transactions with more ease and efficiency.

The above-mentioned characteristics are nothing but the basic framework of banking ERP software. Some of the banks may require customized solutions, which can easily meet all the requirements of the organization. Custom platforms are often required for protecting and managing sensitive data that banks have to work with.

Statistics regarding the digital transformation of the banking sector

The market of banking ERP software had a value of $12.51 billion in 2022, which is estimated to grow even more and reach $47.37 billion by 2030. Hence, it is evident that banking ERP software has been embraced by most of the banking companies all over the world. The overall growth rate is a CAGR of 18.4% during the forecast period.

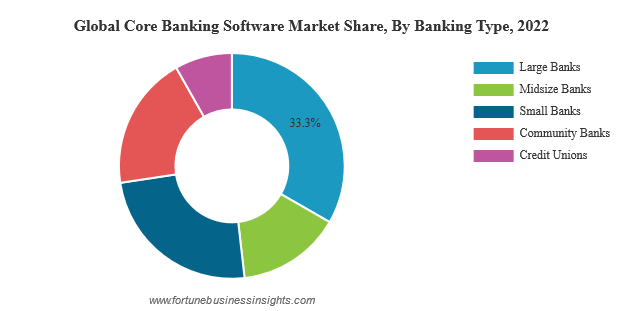

Just as the above picture depicts, according to Fortune Business Insights, 33.3% of large banks have been using core banking ERP software and enhancing their overall performance.

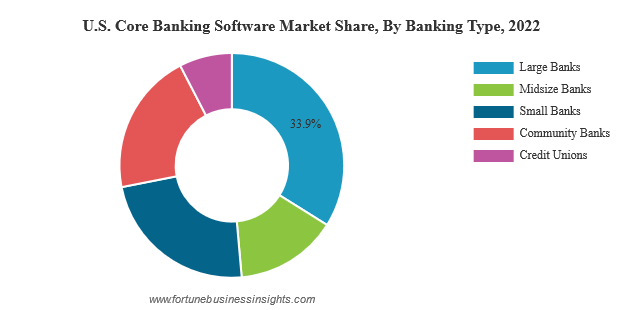

33.9% of the large banks in the US have started using banking ERP software in their daily operations, which has certainly shown improvement in their overall efficiency.

10 most essential features of banking ERP software

In this section of the article, we have listed the 10 most important features that need to be there in banking ERP software. Each of the features is presented with an explanation to help the readers understand why these features are crucial for their banking management ventures. These features are presented below.

1. Customer onboarding

Customer onboarding is one of the most important features to be presented in banking ERP software. With the help of this feature, the banks can easily introduce their several services and products to their new or potential customers. Moreover, this feature allows you to verify your customers’ ids and documents while storing them within the same interface.

2. Managing deposits and withdrawals

Managing countless deposits and withdrawals on a daily basis is certainly something tough to complete without leaving any room for any error and errors in data incorporation and management can lead to bigger disruption. However, automating this entire process does not only eliminate errors but also saves time and effort.

When a deposit or withdrawal takes place, the banking ERP software automatically records it and makes changes in the data. There is no need to manually incorporate data each time.

3. Transaction management

Just as the name suggests, the primary work of transaction management features is to record and store every little data related to transactions. Managing the regulatory factors associated with legal transactions is also performed by this feature. Thus, having an integrated transaction management system is a necessity for every banking ERP software.

4. Advanced security integration

Financial data is always sensitive and needs to be taken care of by an extra mile. In this situation, banking sectors are in need of something that can protect the sensitive financial data of the customers without leaving any loopholes. However, the security that is offered by the banking ERP software is not always enough and the banking organizations might need something stronger. This is why advanced security integration functionalities needs to be presented in the ERP system to offer seamless integration with other third-party security software. An easy integration will lead to a more secure platform that can be used by the banks without any worry.

5. Accounts management

A bank has several different branches and each of the branches has numerous accounts. Managing these accounts was done by keeping an Excel sheet back in traditional banking days. However, these days, with the help of banking ERP software, managing bank accounts has become easy. For new accounts, the ERP solutions can suggest new account numbers automatically. Or when you incorporate the account numbers, it will show you every related detail with just a few clicks. It’s easy to manage and convenient to use.

6. Centralized dashboard

With a single-view dashboard, it becomes easy to visualize the entire banking system in real time. It also allows the bankers to have the same view as the customers, which helps in resolving issues much easier and faster.

7. Loan management

With an integrated loan management feature, it is always more convenient to overview the loans of the customers and every little detail associated with that. You can monitor the progress, the credit score of the customers, customer IDs, and every other important information within a single interface.

8. Regulatory compliance

Incorporating regulatory compliance is a crucial factor when it comes to the banking sector. Maintaining all the legal and regulatory factors, such as KYC (Know Your Customer), is easier when you have a tool to remind you and send you an alert every time there is a risk. Banking ERP software can perform that responsibility well when there is an integrated regulatory compliance feature.

9. Customer analytics

With powerful customer analytics features, bankers can gather valuable customer insights and analyze customer behaviors easily. This allows you to offer your customers personalized offers. Understanding your customers’ preferences and their needs will lead you towards offering them better financial services and your customer retention rate will increase as well.

10. Omnichannel banking management

Omnichannel banking refers to the process of allowing customers to manage their accounts and other banking-related information across channels. The customers can be transferred from one channel to another in real time. They can also access any product and services of the banks at any time they want. Omnichannel banking management requires to be integrated with banking ERP software, which is capable of offering a seamless experience to the customers and an easier way to manage the same for the bankers.

The above-mentioned features are some of the most essential functionalities that you need to look for in banking ERP software. However, the feature list is not limited to these only. If your bank possesses some unique needs, then you need to settle for banking ERP software that can be tailored based on your business needs.

Challenges faced during the implementation of banking ERP software

Even though the banking sector is one of the very first industries to welcome technical changes, there are still some factors that produce some challenges during the implementation of banking ERP software. These challenges need to be overcome to complete the implementation process successfully. Some of the most potential challenges are discussed below.

Adaptability issues

The banking sector is a rather complex one and it is associated with many complicated tasks and business processes. Hence, it is quite common for banks to face adaptability issues while implementing new banking ERP software. It may take some time for the software to fully mold itself to support every business process of a bank.

Lack of available resources

A successful implementation of banking ERP software requires re-engineering of business processes along with abundant resources. Thus, the banks need to draw a map of all the logical strategies that can help transition into a new banking ERP software. Failing to implement proper strategies leads to failed implementation and decreasing performance.

Changes in organizational structure

Implementation of banking ERP software can sometimes trigger a restructuring of the entire organization. This is where things can get more complicated. Restricting an entire organization is time-consuming as much as it is in requirement of effort. Hence, the implementation may end up being much more exhausting and complicated than anticipated.

Hish risk

Implementation of banking ERP software means migrating crucial data from one source to another, which is certainly a process to impose high risk. Leaking and breaching sensitive data during the migration can disrupt the entire process and leave a more complicated issue to deal with.

These challenges need to be overcome to gain a high return on the investment made by implementing the banking ERP software.

Benefits of implementing banking ERP software

Just as there are challenges, there are a lot more benefits that can be acquired with the banking ERP software implementation. Some of these benefits are explained in the following section.

Improvement in business processes

Banking ERP software requires less manual incorporation, automates most of the processes, and eliminates errors. Moreover, automated processes save a lot of time as well, which gradually leads to improved business processes.

Reduction in operational expenses

Implementing banking ERP software can require a hefty amount but it works as a one-time investment. You can also cut down on your expenses with several different applications and software since banking ERP software usually has everything needed in a bank. This certainly saves a lot of expenses and resources by great means.

Recording transactions real-time

In this era of online payments, manually recording every single payment made by your customers is indeed impossible. Banking ERP software records each and every transaction in real-time and stores that in a secure interface, which makes the processes much more convenient for bankers.

Data-driven decision making

Banking ERP software offers reporting and analytics, which can help you enhance your decision-making process significantly. With the help of the customer analytics feature, you can understand your customers and their preferences better.

There are many more advantages and benefits that can be gained when you opt for banking ERP software. However, for that, you have chosen the right banking ERP software for you. If you want to narrow down the list of the most suitable software for you then you can read our article on the Top 10 Banking ERP Software that are trending in 2023.

Conclusion

In conclusion, it can be said that deciding on the right banking ERP software can be a tough task. Hence, to make it easy you can focus on the features that are offered. Nonetheless, you need to compare several solutions before deciding on one, and testing plenty of times is recommended as well.

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.