What Are The Companies To Offer The Best Workers Compensation Insurance In Texas?

When you are an employer, the safety of your workers is one of the primary aspects you need to be ensured about. There can be no gaps, no loopholes to make sure that your workers are safe and so are you. If you are a Texas employer, there is no difference to this aspect. And the best way of ensuring your workers of their health and well-being is by considering the best workers workers compensation insurance in Texas for your employees. Purchasing a beneficial workers compensate insurance can help you into turning an unfortunate situation into a better one, while retaining your employees’ trust on you. For helping you in generating some accurate information in this topic, we have prepared this article for your benefits. This article contains information on the companies that can provide you with the best workers compensation insurance in Texas .

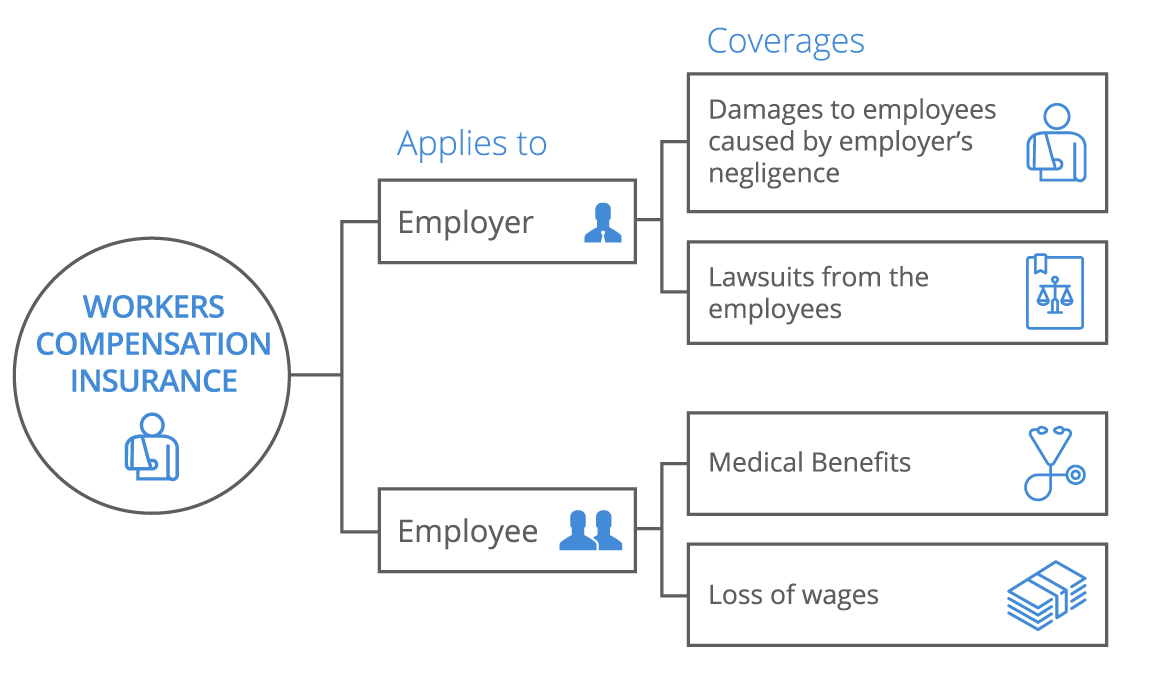

Definition of workers compensation insurance

workers compensation insurance in Texas is an insurance policy that is capable of paying your employees when they get hurt while working for you. It also covers for the employees when they get sick due to something that is related to work, such as traveling. The course of workers compensation insurance is significant for your employees, as they are paid on behalf of the medical care and a percentage of their income when they are unable to work.

As much as it is beneficial for your employees, it is significant for you too. It eliminates the extra worry for medical payments and lawsuits when your employees get hurt. Moreover, it also protects you if your employees file lawsuits against you for an unfair compensation. All in all, considering a workers compensation insurance not only saves your employees but you too while allowing you to run your business uninterruptedly.

Workers compensation insurance in Texas

Texas is certainly one of the most important states of the US, it is one of the largest states as well. However, the state government of Texas, has not made workers compensate insurance mandatory for the businesses. And this is something that bothers the employees on having a safe working atmosphere. Hence, there might be a chance that the business owners are actually skipping purchasing a workers comp insurance and not ensuring the health and well-being of their employees. In this scenario, if you are a business-owner and you want to make sure that your employees are safe, and you do not have much to worry about lawsuits being filed against you then you must go forward and purchase a workers compensation insurance in Texas as soon as possible.

Factors to come under workers compensation insurance in Texas

The insurance policies associated with workers compensate come with similar coverage options in almost all of the states and Texas is no different to it. The factors to come under the coverage options of Texas’ workers compensate insurance policies are provided below.

Medical benefit coverage

The medical benefit coverage compensates the workers for their medical bills when they get injured or hurt while working for you. It pays for the medical bills that you stumble upon for ensuring your workers are safe enough. You will not have to pay anything from your own pocket when you already have a workers compensate insurance.

Income benefit coverage

Income benefit coverage is associated with paying your workers for the days they have to be absent in work due to their ill health. It is not paid in full rather a portion of the entire payment.

Death benefit coverage

In this scenario, an amount is paid to the family of the deceased employees.

The state law of Texas has implanted a proper definition for each of the mentioned benefits along with their limitations. Each type of benefit comes with a specific limitation, which ensure the safety of the workers as well as the liability of the employers. It is needed to be mentioned that the state law emphasizes on return-to-work program as they believe a positive working atmosphere can help the employees in recovering faster.

Factors to not come under workers compensation insurance in Texas

Just as the standard inclusion of benefits, there are some standard exclusions from the workers compensation insurance in Texas. The employers are not liable to pay the employees if they get hurt due to any of the mentioned activities.

Self-injuries

If the employees hurt themselves during work hours willingly then it will not be covered by the insurance plan.

Intoxication

If the employees get hurt while being intoxicated with drug or alcohol while being at work, then it will not be paid by the insurance plan.

Horseplay

When an employee gets hurt due to on-going pranks and horseplay that go on among employees, it will not be covered by the insurance plan.

Willful criminal acts

Criminal acts carried on by the employees are not under coverage options.

Recreational activity

Getting hurt due to recreational activity performed after work is not covered by the insurance policy.

Third-party

If a third-party hurt an employee during their work hours due to personal tensions, then it will not come under the coverage options.

Acts of God

Acts of God and nature are not covered by the insurance plans.

Texas laws regarding workers compensate insurance

There are two mandatory laws that the employers have to abide by in the case of imposing a proper workers compensate insurance policy in Texas. The first law is associated with posting a mandated notice. According to this law, the employers have to notify the employees about the workers compensate insurance that they are providing with during the time of hiring. Hey also need to notify the employees when they are cancelling the insurance policy.

The second law is associated with reporting your requirements. You need to report your requirements that you need in the workers compensation insurance in Texas. You also need to report the limits of liability, the premium and the deductible that you can pay.

The costs associated with workers compensate insurance

The costs that are associated with the workers compensate insurance depends on the different class of work. The costs are a wind-up form of the coverages that are needed to be paid to the workers. These varies from state to state and in each state of the US the costs are different.

| Class Code | Class Code Description | Rate | Annual Pay | State Fee | Annual Employer Premium |

|

2157 |

Wine Makers |

$1.81 |

$50,000 |

$250 |

$5,775 |

|

5474 |

Painting Contractor |

$1.71 |

$41,610 |

$250 |

$4,807.65 |

|

7600 |

Alarm Installation and Repair |

$1.33 |

$48,000 |

$250 |

$4,442 |

|

9052 |

Hotels and Motels |

$1.06 |

$52,800 |

$250 |

$4,048.40 |

|

9079 |

Mobile Food Truck |

$0.58 |

$20,000 |

$250 |

$1,830 |

Table 1

Best companies to provide workers compensation insurance in Texas

We have listed top 6 companies that you can look forward to for buying a functional workers compensation insurance in Texas . Each of the company is a best provider in a certain ground, hence, you can easily choose the one to provide the most suitable coverage option for you.

1. The Hartford

The Hartford is the overall best company for workers compensate insurance in Texas. With 200 years of experience, the company has proved to be the best choice for the employers for countless times.

The large medical-facility provider network of the company is one of the most beneficial factors to come with its insurance policies. With more than 1 million providers, it is easier for your employees to treat their workplace injury.

The company also offers more than 65,000 pharmacies all over the US to provide free medicines according to the prescriptions.

The network of nursing care managers to help the injured workers with their doctor and therapist appointments is another benefit that you can garb from the company’s workers compensate insurance.

With the pay-as-you-go billing solution you will be able to manage cash flow without facing many issues.

2. Progressive

Progressive is certainly one of the best insurance companies to be available in the US. The company provides attractive coverages under affordable price range. Workers compensation insurance of the company is nothing different.

The availability of online tools to make the purchasing and claiming process easier, makes the insureds satisfied with the services of the company.

The average of the company’s Advantage Business Program is only $192 monthly. The rate is a subject to increase or decrease based on the situations, conditions, and factors.

Getting a custom quote is very easy with Progressive. The company’s online quote program is capable of guiding you in a step-by-step process and craft a suitable customize quote for yourself.

3. biBERK

biBERK is the best choice for the small and medium sized companies that are looking for affordable coverage options.

The company offers a low down-payment for the small and mid-sized business owners, while providing them with a full coverage.

With the help of biBERK’s workers compensate application, you can gain your quote much faster and easier than ever before.

The company has a wide range of small business category to be qualified for their comprehensive workman’s compensation insurance. These categories include restaurants, transports, retailers and more.

4. Chubb

Chubb is one of the most popular names in the insurance industry of the US. And its workers compensate insurance comes under one of the most preferred services offered by the company.

The flexible structure of the coverage plans offered by the company is certainly beneficial for the small and medium sized business owners.

The annual premium options provided by the company are quite affordable as well.

The company provides customized quotations to the big corporations and in order to minimize risk and maximize safety measures all around the workplace.

Chubb’s excess workers’ compensation packages allows you to extend your workers compensate insurance for catastrophic exposures.

5. Suracy

Suracy is considered to be the best provider for scalable workers compensate insurance.

The company lets you to cut down on your manual effort of going through the choice of a quotation or claiming a file. The online quotation process of Suracy compile all of your requirements with the available coverages and shows you the most suitable one for you.

Your employees are provided with the needed care with the help of the company’s satisfactory service.

The company takes most your headache so that you can invest your concentration in the growth of your business.

6. CommercialInsurance.net

Unlike the other mentions CommercialInsurance.net is not an insurance company. It is a helpful tool that assist you in your workers compensate insurance quest.

It is an online quoting platform that helps you in comparing a handful of quotes from different insurance companies. You get to choose the most suitable one for you without having to perform much of research.

It is very easy and quick to use. The tool is capable of delivering best results within a fraction of seconds.

There is a lot of information regarding workers compensate insurance available in the site, which can be beneficial for gaining a basic knowledge on workers compensate insurance.

Comparison

| Company | Area of expertise |

|

The Hartford |

Overall best |

|

Progressive |

Best for online quotes and affordable rates |

|

biBERK |

Best for small business owners |

|

Chubb |

Best for flexible coverages |

|

Suracy |

Best for scalable workers compensate insurance |

|

CommercialInsurance.net |

Best online tool for comparing quotes |

Table 2

Above mentioned 5 companies are certainly the most preferred one that you can find in the state of Texas. The Hartford is certainly the best one judging from all of the aspects. And if your company is a small or a mid-sized one then you can go for biBERK and Chubb. on the other hand, if you want to compare the prices and the quotes, you can go with CommercialInsurance.net.

Conclusion

In conclusion it can be stated that workers compensation insurance in Texas is certainly one of the most important insurance programs that you need to consider when you are an employer. The size of your business and the number of employees does not matter in this regard. You need to purchase an insurance to provide safety and security to your employees and to eliminate unexpected situations from your concern.

Resource list: -

For generating more knowledge on comprehensive workman’s compensation insurance, you can follow the provided link.

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.