USAA Renters Insurance 2022 – The Ultimate Guide

Renters’ insurance is one of the most useful insurance policies that are available in the markets and yet not everyone knows well about it. Renter’s insurance is one type of property insurance that is capable of covering the loss of individual property and protecting insured liability claims. Some of the benefits of homeowners’ insurance are provided to renters’ insurance policy holders. However, most of the benefits are certainly deducted since the policy is meant only for the renters or the tenants.

Almost all of the top-rated companies provide renters’ insurance in all over the US. However, there can be confusion on choosing the best company for purchasing the policy, in this scenario many has named the USAA renters insurance as the best insurance policy to cover the needs of the renters. Therefore, to justify the claim, we have prepared this article with incorporation of accurate data in order to help you in determining whether you should buy the said policies from USAA or not.

It is said thatUSAA renters insurance policies are more comprehensive than most of the companies as well as there are added coverages that are associated with the company’s policies, which you will not be able to find in the coverages of any other company. Moreover, even with add-on coverages, the company’s rates are less than the national average. Therefore, purchasing insurance seems to be a good idea, nevertheless, we should dive into further analysis to determine the conclusion.

About the company

USAA was founded by a group of army officers in the year of 1922, they were seeking auto insurance. The company has now grown and taken the shape of a full-functional insurance company with 13 million members. The company has its headquarters in San Antonio, and it is currently offering a wide range of services that not only include insurance but also loans and retirement planning. The company has managed more than 270,000 disaster claims alone in the year of 2020. This amount has added up to their total number of claims and made it more than $2.4 billion. This provides an idea about the company’s popularity in the insurance industry of the US.

Pros of USAA’s renters insurance

Let’s analyze the advantages that you can acquire by considering the assistance of USAA renters insurance.

- USAA is one of the oldest insurance companies available in the US and the age of the company has helped it in expanding their services to all the 50 states as well as in Washington D.C. Therefore, one of the biggest advantages of considering USAA is that it is widely available.

- Unlike other companies’ renters’ policies USAA offers flood and earthquake insurance coverage. This offer ensures your security effectively.

- As it has been stated before the insurance policy rates of the company are very affordable, even lower than the national average. The monthly rate of USAA’s renters’ insurance start only at $10.

Cons of USAA’s renters insurance

- Just as the advantages, there are certain disadvantages that you may have to face if you consider USAA renters insurance as your policy provider.

- The biggest disadvantage associated with USAA is that the company does not provide services to everyone. The company has limited its services to only the members of military and their family. The commoners do not have the access to the beneficial insurance policies of USAA.

- The policies of USAA do not cover the roommates of the policyholders.

Coverages offered by USAA renters insurance

There are two types of coverage available under the coverage options of USAA. The first option is the standard coverage option, which are already included in the package of the policy. The second one is the added coverage option, which needs to be purchased as an add-on in order to gain the service.

Standard coverage options

|

Type of coverage |

Description |

|

Personal property coverage |

Through this type of coverage USAA offers the protection of the renter’s personal property against perils. However, the peril needs to be listed. The replacement cost is paid by the policy unlike most of the companies, which only pay the estimated value. |

|

Medical coverage |

The medical fees of a guest, who is injured on the renter’s property, is covered by the insurance policy. |

|

Additional living expense coverage |

If the rented space is somehow unliveable after an invasion of a peril, then the additional living expense will be covered by the policy. |

|

Personal liability coverage |

The personal liability coverage covers the legal defence costs that is burdened upon you when someone gets injuries in your rented space. USAA renters insurance policies can cover up to $100,000, which is certainly beneficial. |

Additional coverage options

|

Type of coverage |

Description |

|

Umbrella insurance policy |

This policy is capable of covering an increased liability coverage, which can take care of major lawsuits and claims. by purchasing the umbrella coverage, you can ensure a better protection to your household members. |

|

Valuable personal property |

This insurance policy is capable of protecting the individual property that cost more than $100. This policy cover the |

|

Collectibles insurance |

This coverage option is designed for protecting personal collection. The personal collections to be eligible for this type of insurance are, coins, figurines, wine, vintage dolls, pop culture memorabilia, sports, military equipment, stamps and more. |

|

Mobile phone protection |

This is one of the most beneficial insurance policies that offers full coverage on mobile devices for $99.99 annually. The company replaces the damaged, lost or stolen mobile phones within 48 hours for a $199 fee. |

|

Small business insurance |

The renters who run a small business within their homes will be able to gain this policy in order to protect their small business equipment. The replacement of repair cots is provided based on the selected policy. |

Discounts offered by USAA renters insurance policies

There are some of the benefits that you can gain if you are opting for USAA renters’ insurance policies. The discount types are presented below:

- On-base discount, if you are living in a military base then you can be eligible for saving up to 28% on a policy offered by USAA. This only applies if you are living in a miliary dorm or a barrack.

- Claims free discount, this discount is offered to you when you do not make a single renter’s claim in last three years.

- Bundle policy discount, if you have bundled up your renter’s policy with a car insurance policy from USAA then you are eligible for gaining this discount.

Online Renters Insurance tools offered by USAA

USAA has made management oof policies easy for the policyholders by making a number of online tools available for their use. Other than the official website, these online tools can help the insureds to track their policies seamlessly without facing any issues. The online tools that are available have are mentioned below:

- Mobile application, USAA mobile application lets you manage your financial services, such as banking, investing and insurance.

- Online price quotes, this tool measures your eligibility for getting a renters’ insurance quote.

- Calculators, this tool helps you in calculating homeowners’ insurance, debt, savings, and retirement finances.

- Online claims, this tool lets you file a claim via online means. You can file your claim by the company’s website or by the mobile application.

- Payment options, with the help of this tool you can choose the payment method that is the most flexible to you. The availability of the mentioned options depends on your location.

- Financial advice, with the help of this tool you can gain a financial consultation on property purchase, retirement planning and more.

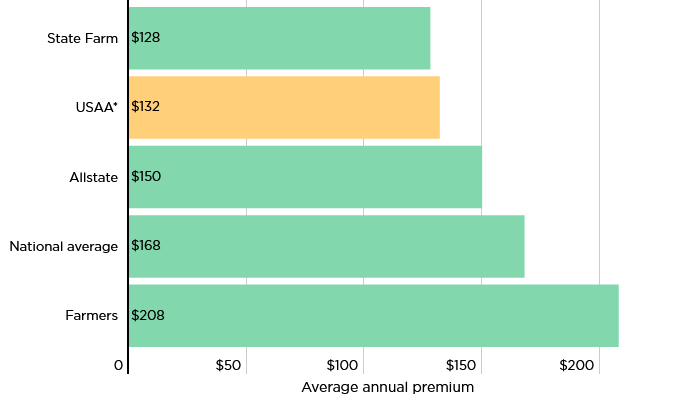

USAA renters insurance vs. other companies

In the US you can always find more than one insurance companies to seek services from. It can be quite confusing to determine the insurance policy from a single company to match all of your requirements. Hence, it is important to compare the prices and the coverages provided by the companies in order to reach to a firm decision. In this section of the article, we will compare the average annual premium for judging USAA’s eligibility.

|

Company |

Annual rates (average) |

|

State Farm |

$128 |

|

Auto-Owners |

$126 |

|

USAA |

$132 |

|

American Family |

$149 |

|

Nationwide |

$151 |

|

Lemonade |

$154 |

|

Allstate |

$150 |

|

Farmers |

$208 |

|

National average |

$168 |

Table 1

From the above table it is quite clear that USAA is not only one of the most affordable options available, but it is also one of the three companies to provide insurance plans under the national average rate. State Farm and Auto-Owners provide services that are less priced than USAA, which is $132. State Farm offers policies from $128 annually and Auto-owners offers from $126. However, both of the companies do not provide flood and earthquake coverage unlike USAA, which means USAA can be a wise choice if you want to protect your property from said natural disasters. Moreover, the customer satisfaction rate of USAA is rather high, which provides an idea about the satisfactory service provided by the company. The smaller number of lodged complaints against the company only strengthens the ground of the previous statement. USAA also cover the former partners of the USAA members, only if they are not remarried. The widowers are an exception.

However, the biggest disadvantage possessed by the company can not be overlooked. Since the company and is services are only accessible to the members of military household, the company has been excluded from many ranking systems. Not being available to the common people has become the biggest competitive disadvantage. Hence, if you do not belong to a military family, you cannot enjoy the satisfactory service of USAA renters insurance.

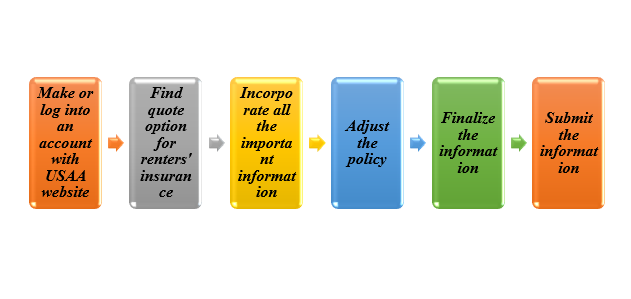

How to purchase an USAA renters insurance?

The online assistance provided by the company has made it easier to buy insurance policies via online means, without taking any help from any agents. The process of buying an USAA renters insurance is provided below via step-by-step format.

- At first you need to make an account for being a valid member of the company. For that you can open the USAA website and click of the “join USAA” link. Or if you already have an account with the company then you will only have to log into your account.

- Then you can search for the option that leads you towards getting a quote for renters’ insurance. You then need to incorporate all of your details, which will include all of your basic information, such as the policyholder’s name, phone number and address. An initial quote will be given to you based on your information.

- After completing the second step, you need to choose a policy and adjust it based on your preferences. You can always add or deduct coverages to make the policy suitable for you. This is a crucial step as the annual premium will be based on the choices that you make

- This is the very last step of the process. In this step you need to go through the details and finalize those. There will some of the important information to consider, such as the payment method and the start of the policy date. Make sure you are choosing everything correctly and going through the details multiple times to avoid mistakes. Once you submit all of your choice, you will receive the details of your new policy.

How to claim a renters’ policy file?

Just as buying the policy claiming a file with USAA is quite easy as well. You can perform the mentioned activity by using USAA website or mobile application. Upon logging into your account, you need to incorporate all the important information such as the policy number, the date, the reason of your file claim and the description of the event or accident. You can also add photos, videos and documents as evidence. You can also claim a file by calling on the main phone line of the company.

Conclusion

This article has a description on the USAA renters insurance policy, along with all the information that you need to know. This article mentioned the pros and cons associated with the renters’ insurance policy of the company as well as a comparison with other companies to help you in deciding whether you should go forward wit the company or not.

Resource list; -

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.