The Pros And Cons, Annual Rates, Discounts And Comparison Of Amica Car Insurance Plans

Amica Mutual Insurance Company is the oldest car insurance company in the US. The excellent ratings associated with the company’s financial strength has made it one of the most preferred car insurance companies by the commoners. Additionally, the attractive coverage options and the benefits provided with those enhance the company’s popularity even more. However, choosing an insurance plan is a crucial factor since it plays a vital role in protecting your car. This is exactly why analyzing each and every aspect associated with the company’s car insurance is important to determine whether to go forward and buy an insurance plan or not. In this regard, we are here to help you. This article is developed highlighting the pros and cons that are associated with Amica car insurance plans, for helping you in making your choice.

About Amica Mutual Insurance Company

Amica was founded in the year of 1907 and is considered to be the oldest car insurance company in the US. Amica is licensed to do its business in almost all over the US. It offers its services in Washington DC and other 50 states, however, they do not offer auto insurance in the state of Hawaii. Except for just auto insurance Amica offers homeowners’ insurance, renters insurance and life insurance. The approach of Amica is associated with directly selling its insurance policies to customers and providing online and telephonic customer service.

Amica car insurance coverages are capable to including all the important options that are undeniably necessary to a driver. Starting from liability coverage and ending in comprehensive coverage, it not only covers all the standard options but also offers other added coverage options that one may not find in other companies. These type of additional coverage options includes full glass coverage, gap coverage, accident forgiveness and other options. This does not end here, Amica offers a premium car insurance program that is referred as the Platinum Choice Auto. This premium feature offers the customers a number of perks which includes glass repair or replacement with no deductible, coverage associated with new car replacement, car rental coverage with no daily limit and more.

Types of coverages offered by the company

As it has been stated in the previous section Amica car insurance offers a wide range of coverages in its insurance plans. It is better to discuss the coverage options provided by the company by categorizing it. Hence, we have divided the coverages in three categories, which are the policy coverage, the vehicle coverage and the premium coverage.

Policy coverage

|

Coverage type |

Description |

|

Property Damage Liability |

This type of coverage is capable of paying the damages that you cause in an accident. |

|

Bodily Injury Liability |

This type of coverage is capable of paying the medical bills that surface after an accident takes place. |

|

Medical Payments Coverage |

This type of coverage is capable of paying the medical payments that takes place after an accident. |

|

Personal Injury Protection (PIP) |

This type of coverage is capable of paying the extra costs associated with miscellaneous situations and liabilities. |

|

Uninsured and Underinsured Motorist Protection |

This type of coverage is capable of paying for the liabilities that are caused by other drivers if they are not fully insured or they are not insured at all. |

Table 1

Vehicle coverage

|

Coverage type |

Description |

|

Collision |

This type of coverage plays for the damage that is made after a collision. It pays for the damages made by another car as well as the damages made by your car. |

|

Comprehensive |

This type of coverage pays for the other type of damages that gets to associate with your car. However, there are some standard exclusions, which include hail, theft, animal invasion, fire etc. |

|

Roadside Assistance |

The roadside assistance is one of the most important coverage options. It provides you with an option of on-road help that you might need, such as towing, tire change and other type of on road assistance. This is an add-on coverage. |

|

Glass Coverage |

This coverage pays for the replacement and repair for the glasses |

|

Rental Reimbursement |

This pays for the rental fees that are needed after your car faces an accident and is being repaired. |

|

Gap Coverage |

This coverage helps you in decreasing the gap that persist between your debt and your car’s worth ad when you face a total loss. |

Table 2

Platinum coverage options

Platinum coverage options are associated with some of the best coverage options offered by Amica. Starting from glass repair, there is credit monitoring, rental coverage and other added options. It needs to be mentioned in this scenario that only the customers who buy the Collison and coverage insurance policies will be able to sign themselves up for the Platinum coverage program.

Types of discounts offered by the company

Along with all the attractive coverage options the company offers a number of discounts that are capable of ensuring significant benefit to the insureds. The potential discounts offered by the company are presented below:

Policy Discounts

|

Discount type |

Description |

|

Loyalty Discount |

After you spend two years of being insured by Amica, you gain this type of discount. The amount of the discount is proportional to the time that you spend being insured with the company. |

|

Claim-Free Discount |

This discount is provided to you when you have made no claims in three years. |

|

Multiple Policy Discount |

You gain this discount upon bundling up your other policies with your car insurance. You may save up to 30% |

|

Multiple Vehicle Discount |

If you have more than one vehicle and all of them are insured by Amica then you might be eligible for a 25% discount. |

|

Legacy Discount |

This discount is provided to you if you are under 30 and your parents already have an insurance with Amica for at least 5 years. |

|

Homeownership Discount |

In special cases the company provides with this discount even if the house is not insured by Amica. |

Table 3

Vehicle Discounts

|

Discount type |

Description |

|

Anti-Theft Discount |

If you add an approved anti-theft device to your vehicle, you can gain a discount from the company. |

|

Passive Restraint Discount |

If your vehicle is equipped with automatic occupant restraints, the company will provide you with a discount |

|

Adaptive Headlight Discount |

If you have added an adaptive headlight to your car then you can gain a discount from Amica. |

|

Forward-Collision Warning Discount |

This discount is provided to the customers who have a collision-warning feature equipped in their cars. |

|

Electronic Stability Discount |

This discount is provided to the customers who have an electronic stability control feature equipped in their cars. |

Table 4

Driver discounts

There are a number of discounts offered by Amica based on the type of driver. Driver discounts by Amica includes, defensive driver training discount, driver training discount, good student discount and school away discount.

Payment discounts

The payment discounts offered by Amica offers Autopay discount, paperless discount and paid-in-full discount.

Pros of Amica Car Insurance

The advantages that you can gain by purchasing an Amica car insurance plan is provided below:

Satisfactory customer service

Amica has been rated as the top company in both England and the US for its up-to-the-mark customer service. It has a direct-to-customer approach and sells insurance to the customers directly via its online channels. The customer support of the company is available for 24X7. It allows the customers to claim files from Monday to Friday with the help of their online chatbot. Amica mobile application offers a good number of features and is available for both iOS and Android devices.

Availability of multiple discount options

At it has been stated in the previous section, Amica offers a number of discounts that you may not find in the offers of other companies. There are discounts for loyal customers, customers that are good student, legacy customers and more.

Easy file claims

Claiming file is easier with Amica’s efficient mobile application. You will not have to deal with any agent for claiming a file. It is an easy and convenient process that takes up a very little amount of your time.

Live chat

The availability of live chat has made it easy for the customers to connect with the company at any time they want. Easy answers to questions within the reach of fingertips certainly enhances the experience of the customers positively.

Platinum coverage options

When you consider a platinum coverage, you get some of the most beneficial features added to your insurance plan. This is something that provides your car with full protection and more. It is the ideal deal for the people who won expensive cars.

Cons of Amica Car Insurance

Just as advantages there are a number of disadvantages that you can face upon purchasing an Amica car insurance plan. The disadvantages or the cons are explained below:

Varied availability of discount

Amica might have a lot of discounts available, however, it does not provide the same type of discounts to all over the US. There might be some states, which are deprived of these beneficial discounts.

No rideshare coverage

Rideshare insurance is important factor if you have a plan of driving an Uber or Lyft for extra money. The lack of rideshare coverage disrupts the good reputation of the company.

Delay in claim handling

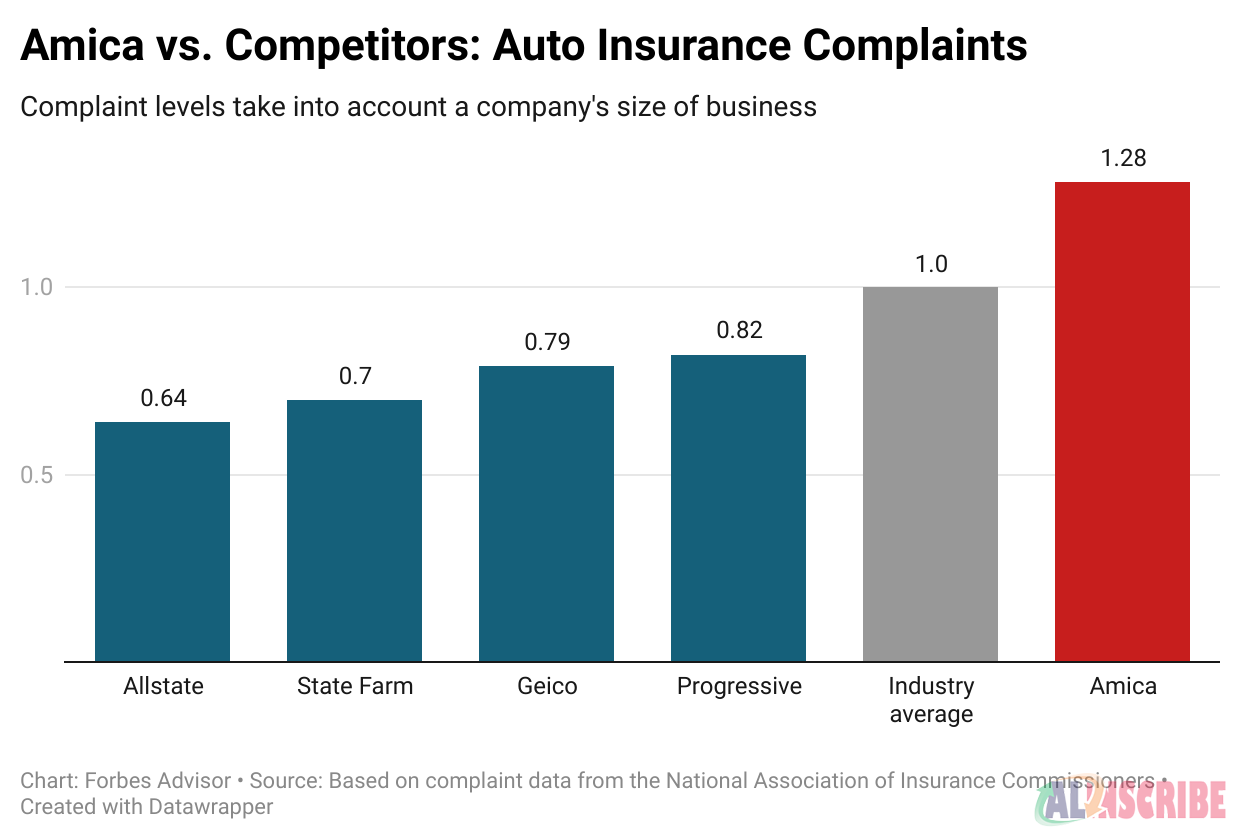

Amica has been a subject to constant reports in the matter of delay in file claim processing. This is another factor to stain the reputation that the company holds in for all these years. Having no agents to process with file claim is what make the process slow.

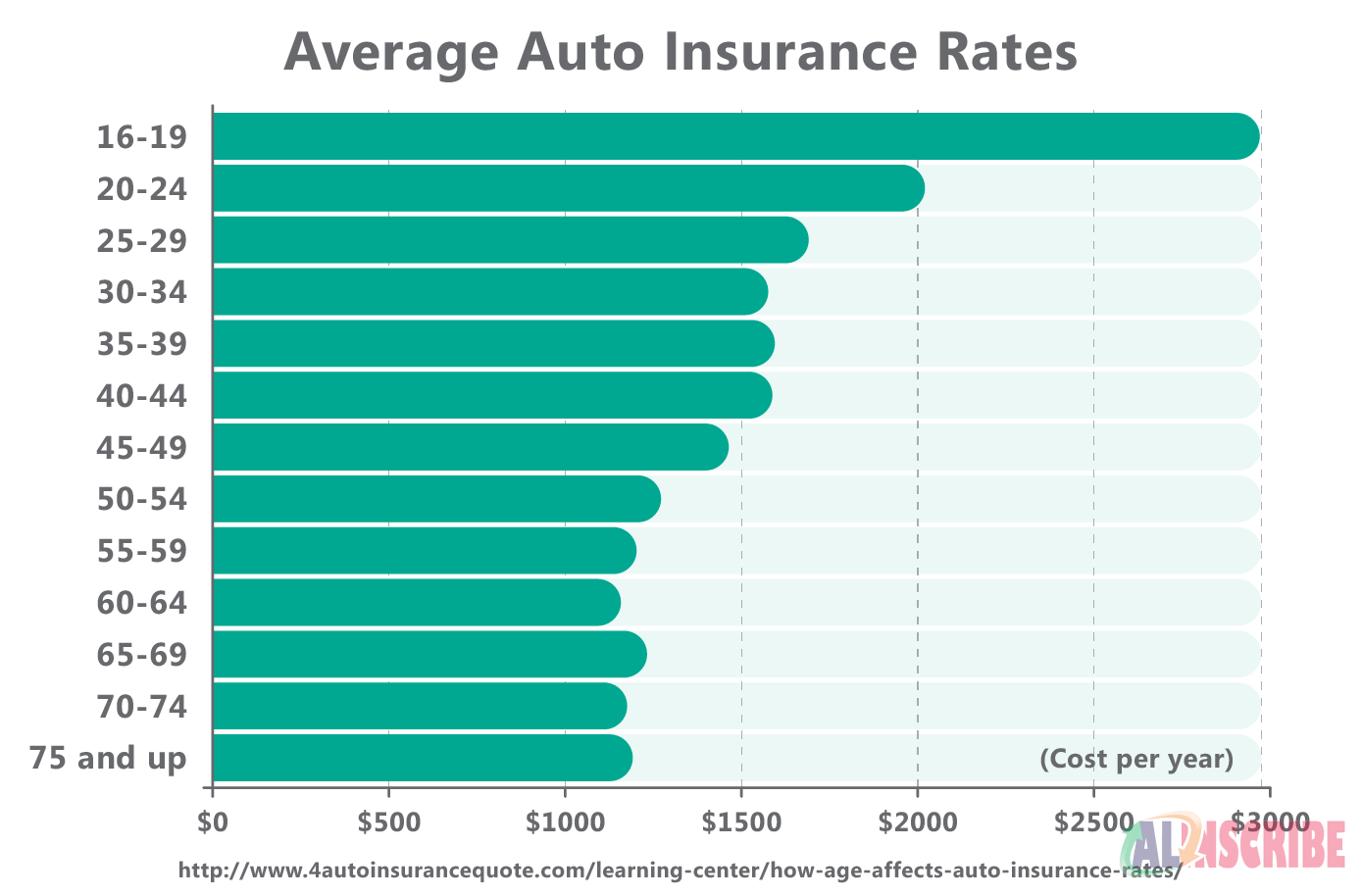

Higher rates

The rates of Amica’s car insurance can be higher than the national average. It sometimes appears to be higher than the top competitors as well.

The cons or the disadvantages are important to be analyzed beforehand as those are the factors that help you in determining whether a company is providing all the important facilities in their insurance plans that you look forward to have in your insurance policies.

Comparing with other companies

After analyzing all the advantages, disadvantages, the offers and the discounts of Amica, now it is important to analyze and compare the car insurance rates for reaching to the conclusion. In all over the US a good number of companies are available for auto insurance services. Some of the companies are capable of giving Amica a tough competition. Hence, in this section a comparison of Amica’s insurance rate with other insurance companies are provided.

Amica’s car insurance rate Vs. National Average

|

Type of Coverage |

Amica’s Annual rate |

National Average |

|

Full coverage |

$1,262 |

$1,345 |

|

Minimum coverage |

$630 |

$768 |

|

Speeding ticket on driving record |

$1,537 |

$1,711 |

|

Yong drivers (18 year olds) |

$4,579 |

$5,148 |

Table 5

From the above table it is quite clear that Amica’s car insurance plans are cheaper than the national average, and it can be a beneficial factor for you if you are looking forward to purchase from the company. However, it is needed to be noted that the car insurance rates varies based on the states, hence, you may not get their cheap plans if your state is not listed under the list of gaining cheap services from Amica.

Amica Vs. Other companies

|

Company |

Average annual rate |

|

USAA |

$1,141 |

|

Geico |

$1,182 |

|

State Farm |

$1,402 |

|

Erie |

$1,419 |

|

Travelers |

$1,435 |

|

Auto-Owners |

$1,532 |

|

Nationwide |

$1,540 |

|

Progressive |

$1,892 |

|

Allstate |

$2,022 |

|

Farmers |

$2,124 |

|

Amica |

$1,262 |

Table 6

The above table contains the insurance rate that a good driver needs to various companies in the exchange of a full coverage auto insurance plan. It can be seen that USAA and GEICO are apparently cheaper than Amica. However, USAA is only available to the people with military background. Thus, GEICO is the company to give Amica a tough competition. You can analyze GEICO’s price and policies to finally choose the company that is the best for you.

Conclusion

In this article we have discussed the pros and cons, the coverage types, the discounts that are provided by Amica. Hope this article will be helpful for you to decide whether you should go forward with Amica car insurance or not.

Resource list:-

Amica Mutual Auto Insurance Review: Quotes and Service (2022)

Article Comments

Similar Articles

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.