Capital Markets Of India

1.Introduction:

A Financial market is a market where Financial Securities such as Equity, Bonds, Derivatives and Currencies are traded. Financial Markets have gained much popularity in almost every country and are known for its trading activities that empower the investors or the holders of securities trade their securities.

2.Types of Financial markets:

Financial markets are classified based on the type of securities traded, which are as below:

- Capital Markets: Capital markets are divided into Stock markets and Bond markets where Equity or Common stock and Bonds are traded in the respective markets,

- Commodity Markets: Where produce of Primary Economic sector (Commonly referred as “Commodities”) are traded,

- Derivatives Market: Where Derivatives are traded,

- Futures and Options Market where Future and Options are traded,

- Foreign Exchange and Inter-bank markets where Currency or Foreign exchange is traded,

- Money Markets which provides for Short term debt financing and Investment.

3.Capital Markets:

Capital markets are the indicators of the strength of economy with long and indefinite maturity for companies and enhance the capital formation in the country. It also offers various investment opportunities to investors with no geographical limitations.

Capital Markets are classified into Primary Market and Secondary Market.

Primary market: It is a market where new securities are traded for the first time. It is also referred to as “Initial Public Offer (IPO) Market”. The securities are bought from the issuer entity itself.The main objective of issuer entity is to raise capital.

Secondary Market: Also referred as “Aftermarket” it is a market which facilitates investor to Investor trading i.e Unlike in Primary market the securities are traded between investors.

The main objective of trading in the secondary market is Liquidity of the Investors. Liquidity refers to the security being sold in the secondary market without its loss of value. Liquid securities are more beneficial for the investors as they can sell their securities at any point of time. An active secondary market for a security refers that there are many buyers and sellers willing to trade with that security.

Participants of capital markets are,

- Investors (Buyers and sellers of the securities issued by the companies)

- Companies or entities (Issuers of the securities)

- Stock exchanges

- Intermediaries (Entities that offer various services in relation to capital markets like Merchant bankers, Stock brokers, Underwriters etc.)

- Depositories (Entities that hold the securities of the investors in Electronic form). There are two depositories in India namely Central Depository Services Limited (CSDL) and National Securities Depository Limited (NSDL).

4.Stock Exchanges:

A Stock exchange in simple terms is a place where Stock or Securities are exchanged between Traders and the Investors.

Securities (Contracts Regulation) Act, 1956 defines a Stock exchange as “an association, organization or body of individuals whether incorporated or not, established for the purpose of assisting, regulating and controlling the business in buying, selling and dealing in securities”

The main function of the stock exchange is to provide liquidity for the securities by facilitating free and transparent trading of securities and mobilization of resources of the companies. It governs and regulates the trading of securities to protect the interest of the investors. The stock exchanges are envisaged as Self-Regulatory organizations.

There are two leading stock exchanges in India

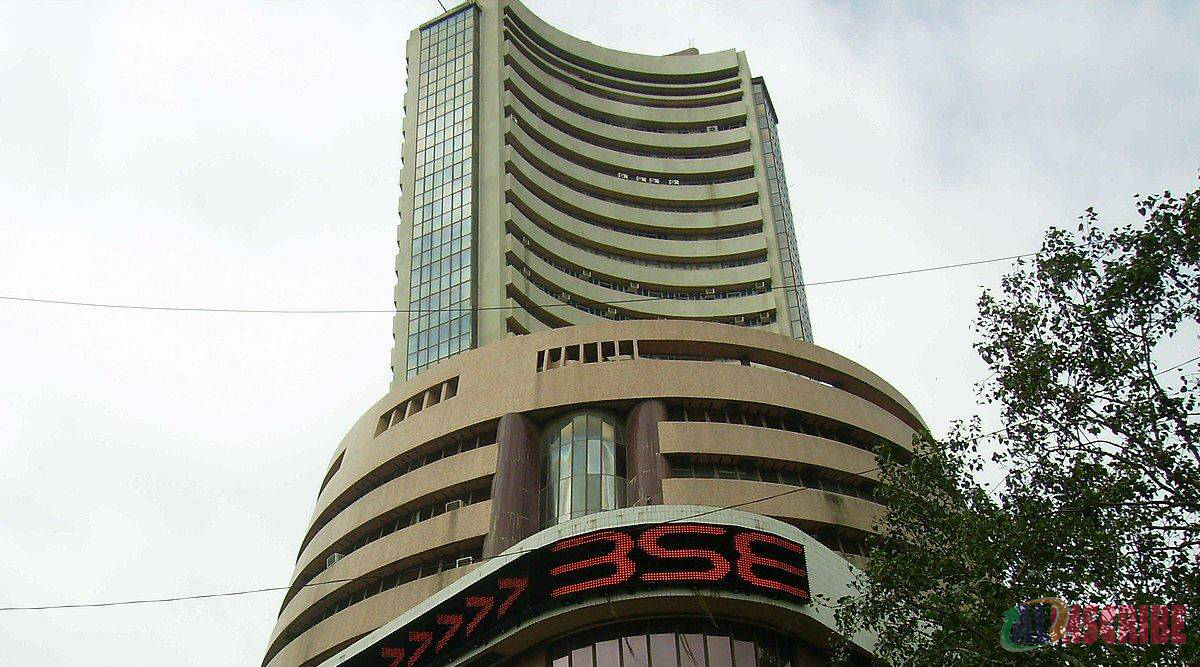

Bombay Stock Exchange (BSE):

The oldest stock exchange in Asia established in 1875 as “The Native share & Stock Brokers Association”. It was the first stock exchange to be get permanent recognition in 1956 from the Government of India under the Securities Contracts (Regulation) act 1956. The Exchange provides an efficient and transparent market for trading in equity, debt and derivative instruments. The BSE’s On Line Trading System (BOLT) is an exchange system certified under BS 7799-2-2002. The surveillance and clearing & settlement functions of the exchange are ISO 9001:2000 certified.

National Stock Exchange (NSE):

It was incorporated in November 1992 as a tax-paying company unlike other stock exchanges. On its recognition as a stock exchange under Securities Contract (Regulation) act 1956 in April 1993, NSE commenced its operations in the Wholesale Debt Markets (WDM) segment in June 1994. The capital Market Equities segment operations commenced in November 1994 and operations in Derivatives segment in June 2000.

NSE is one of the largest VSAT based stock exchanges in the world. It supports more than 3000 VSATs. NSE is the country’s largest Information Technology User.

5.Major Stock Exchanges abroad:

The major Stock exchanges abroad are,

New York Stock Exchange (NYSE)

Established in the year 1792, NYSE is the largest trading stock exchange with a Market cap of 19223 billion US$ as of 31 January 2015 as reported by World Federation of Exchanges. It operates as a traditional floor based market where auction, open bid and offers are made on the Trading floor. Buy and sell orders of securities are managed on the trading floor itself.

NASDAQ:

“NASDAQ” stands for “National Association of Securities Dealers Automated Quotations” established in the year 1971 and owned by Nasdaq Inc. is situated in New York. It stands in the 2nd place in terms of Market capitalization behind the NYSE with a market cap of 6831 billion US$. It is known for its Liquidity, growth and use of technology. It is a Screen based market operating and trading in highly competitive electronic trading environment.

London Stock Exchange

London stock exchange was formed when in the year 1760, about 150 workers were removed from the Royal Exchange. These workers then formed a club at Jonathan’s Coffee house to buy and sell shares.

Later in the year 1773, the members voted to change its name to Stock exchange and 2000 shareholders voted it to become a Public limited company and that was when London Stock Exchange Plc was formed. The London Stock exchange stands 3rd in terms of Market capitalization with a market cap of 6187 billion US$.

6.Index:

Index is a statistical measurement of valuing the changes in the Securities or Stock market. It is a representative of the entire stock market. It is calculated in terms of change in index in relation to price. Movements of the index represent the average returns earned by the investors in the stock market. It describes the market and the trading of securities by giving the investors and stake holders an idea about the securities and the return it can fetch.

Stock Indices refer to the expectation about future performance or earnings of the companies listed on the stock exchange. The index and the market expectations have a proportional relationship that is if the market expectations as to future performance increases, the index also increases and vice versa. Though the market indicates expectations on future performance, it is highly affected by the past track of the company.

Indices are mainly considered while dealing in securities like Mutual funds, Exchange Traded Funds (ETF’s) which explains the rise or fall in the value of security in relation to the market forces. A base year is set along with base group of shares. The change in price of these shares is calculated on a daily basis. The shares included in the index are usually the shares that are traded in high volume. If the trading in those shares cease or reduce, then those shares will be replaced with other shares which are being traded in high volume.

Each stock exchange will have its own flagship Index like Sensex of BSE and Nifty of NSE in India.

The index used in BSE is called “SENSEX” which is also referred as BSE30 which is a market index of 30 well-established companies that are listed on BSE.

Nifty50 is the index used in NSE which is consists of 50 stocks covering 22 sectors in the Indian economy.

7.Market Capitalization:

Commonly referred to as Market Cap, it refers to the “Total value of shares being traded”, which is calculated by multiplying the Current market price or trading price of the security with the total number of shares available for public trade.

Companies listed on stock exchanges are generally classified as Large-Cap industries, Mid-Cap industries and Small-Cap industries based on the market capitalization of the entities.

Large cap industries are well-established market players having a capitalization of US$ 10 billion or more. Market capitalization doesn’t refer to the returns that can be earned from that company. But the players or industries can increase their capitalization by consistently meeting the expectations of the investors like declaring dividend consistently year after year, increase in the revenue of the company etc.

Mid cap industries are the industries having capitalization of US$ 2 billion to US$ 10 billion. Mid cap companies can raise into large cap companies by expanding or diversifying the business. Mid cap industries usually have high growth potential and tend to have higher risk compared to large cap industries.

Small cap industries are the industries which have a capitalization ranging between US$300 million to US$ 2 billion. These companies are usually the companies which were recent entrants or companies with fewer resources. Investments in these companies possess high risk due to the market forces and other large scale industries in the same industry. These companies have to offer a higher return to the investors for withholding their position and the investor base.

8.Trading in or Working of the markets :

To make the trading more transparent, the BSE and the NSE facilitates exchange or trading through the computer called Open Electronic Limit order book. The matching of the buy and sell orders is automatically done through electronic means and this process is called Order-Driven process. The main aim of this is to provide transparency in trading between buyers and sellers and they will stay anonymous. The system displays all orders on the system itself thereby eliminating the intermediaries or market makers.

Any orders whether buy or sell has to be placed through the stock brokers. Large scale investors or Institutional Investors can place their orders directly into the stock market by using the facility called “Direct Market Access (DMA)” , where the institutional investors are provided with terminals for order processing. Since the orders are placed and executed electronically, there is less risk of errors and the processing is done fast which gives the traders to invest in short timed securities.

In the article referred below, we will be discussing in detail about the participants in the market, Regulatory body,Settlement process.

https://www.alinscribe.com/articles/362/participants-of-stock-market-and-settlement-process.html

Article Comments

Articles Search

Sponsor

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.

There are zero sub-categories in this parent category.